Overview of Employment Attorney Costs

Most employment attorneys’ hourly rates depend on the location, experience of the attorney, and reasons for suing your employer. Many employment attorneys charge an hourly rate for handling employment cases if their client is the employer. The average cost for a lawyer to sue an employer ranges from $200 to $650 per hour. A contingent fee arrangement is best for workers who want to sue their employers but cannot afford to pay a lawyer by the hour.

Having the right to file a lawsuit against your employer is only part of the equation; understanding the cost and options is equally critical. In California, the legal landscape offers clear protections for workers, and many attorneys work on a contingency basis, ensuring access to justice without upfront financial burdens.

Types of Legal Fees

Contingency Fees

If you hire your lawyer on a contingency fee basis, you will only pay them if they win the case. Payment will usually be as a percentage of the money recovered, usually 35% to 45%. This is a great option if you do not have the money to pay your lawyer on an ongoing basis. Our lawyer to sue employer works on a contingency basis: $0 upfront, and no fee unless we collect money for you. Attorneys with a successful track record may charge higher percentages, reflecting their expertise in securing favorable settlements.

Hourly Fees

Attorney’s fees can vary significantly, but expect at least $200 per hour for an attorney. It is usually best to pay per hour if you need them for a specific service; otherwise, it can add up quickly! Our law office represents employee lawsuits on a contingency basis: $0 upfront, and no fee unless we collect money for you.

Reasons Employees Sue Employers

Discrimination

Discrimination is one of the most common reasons employees sue their employers. Employers are prohibited from treating employees unfairly based on protected characteristics, such as race, gender, religion, national origin, disability, age, or sexual orientation. California law, under the Fair Employment and Housing Act (FEHA), ensures that employees have a right to work in an environment free of discrimination at all stages of employment, including hiring, promotions, and termination. If an employee feels they have been unfairly treated due to these factors, they can file a lawsuit.

Wrongful Termination

Even in an “at-will” employment state like California, employers cannot terminate employees for unlawful reasons. Wrongful termination occurs when an employee is fired due to discrimination, retaliation, or whistleblowing. California law protects employees from being fired for reporting workplace harassment, participating in investigations, or requesting reasonable accommodations for disabilities or religious beliefs. Employees wrongfully terminated have the right to seek compensation.

Wage and Hour Violations

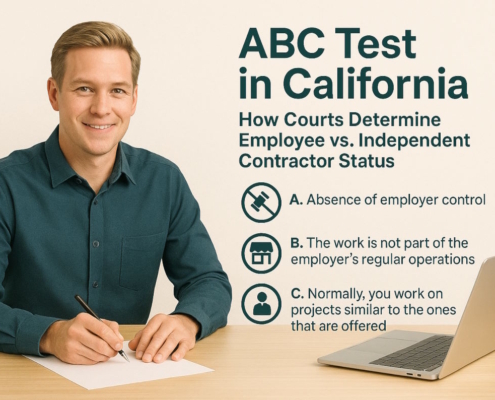

California has robust wage and hour laws ensuring that employees are fairly compensated for their work. Employers must pay at least the minimum wage, provide overtime pay for eligible employees, and ensure workers receive mandated breaks. Violations, such as misclassifying employees to avoid paying overtime or withholding wages, are illegal and give employees grounds to sue their employer.

Hostile Work Environment and Retaliation

A hostile work environment arises when workplace conditions are abusive or discriminatory to the extent that they interfere with an employee’s ability to perform their job. Retaliation is when an employer takes adverse action against an employee for reporting illegal activities or discrimination. Common retaliatory actions include demotion, pay cuts, or denial of benefits. Both conditions are illegal under California law, and employees facing these challenges can file lawsuits.

Breach of Employment Contract

Employees with formal employment contracts can sue their employers if any terms of the agreement are violated. This includes failing to pay agreed-upon wages, denying benefits, or violating working conditions specified in the contract. California law protects employees from contract breaches, ensuring they can hold their employers accountable.

Failure to Accommodate Disabilities and Religious Needs

California law requires employers to provide reasonable accommodations for employees with disabilities or sincerely held religious beliefs. This can include modified work schedules, accessible facilities, or time off for religious observances. If an employer fails to provide these accommodations without valid reasons, the employee can file a discrimination lawsuit.

Harassment and Sexual Harassment

Harassment in the workplace, including sexual harassment, is illegal under California law. Harassment can take many forms, such as unwanted advances, inappropriate jokes, or creating a hostile environment. Employees who experience harassment have the right to seek legal action against their employer to ensure accountability and a safer workplace.

Legal Protections for Workers in California

California’s employment laws are among the most employee-friendly in the country, protecting workers from discrimination, harassment, and wage violations. However, legal representation is often necessary to ensure these protections are enforced effectively.

Filing a Complaint with the EEOC

If you file your employment discrimination case with the US Equal Employment Opportunity Commission (EEOC), you will not be charged for filing the lawsuit. The EEOC will try to mediate with your employer to reach a satisfactory solution. If this mediation fails, the EEOC will then file a federal lawsuit. In some cases, they are unable to file a lawsuit and will notify you in writing and give you 90 days to file your own lawsuit. Attorneys can assist in navigating this process and ensuring your rights are protected.

Strong Cases and Contingency Arrangements

If you have a strong case, an employment attorney to sue employer may accept your case on a contingency basis. It will be unlikely that your attorney will lose the case and therefore earn nothing. When they win, they will receive a percentage of the settlement or judgment, usually between 20% and 50%. Lawyers with a successful track record for large settlements might charge a higher percentage than other attorneys. If the case settles and doesn’t go to court, your attorney might take a lower percentage of your settlement.

Costs Associated with Litigation

The complexities of litigation underscore the need for experienced legal counsel.

Court and Additional Fees

For example, if the case goes to court, fees for expert witnesses, court fees, and other expenses will be deducted from your settlement. These will generally be around $10,000, but your employment lawyer to sue employer will be able to give you a more accurate estimate based on your case. Attorneys may also handle your case on a partial-contingency fee basis and expect you to pay these costs whether you win or lose your case.

Hourly Legal Fees for Complex Cases

Some employment attorneys handle employment discrimination cases on an hourly basis because they can be difficult to prove. Depending on the attorney’s hourly rate, it may be between $100-$600 per hour. Court costs and other expenses will be charged on top of this. Hourly legal fees can add up quickly, especially for complex cases that need a lot of legal work from a lawyer to sue employer.

Navigating the Legal Process

The legal process can be lengthy, often requiring pre-suit investigations, filing complaints with regulatory bodies such as the EEOC or California Department of Fair Employment and Housing (DFEH), and navigating court procedures. Each phase, from initial consultation to resolution, involves careful preparation and legal expertise.

Our Commitment to Affordable Legal Services

Our office charges $0 upfront, and there is no fee unless you win! With this structure, workers can focus on pursuing justice without the stress of financial burdens. Legal advocacy ensures that workers are empowered to fight for their rights, recover damages, and hold employers accountable for unlawful practices.