What is disability pay in California?

Typically, for the first 52 weeks of a disability, SDI will pay between 60% and 70% of your usual earnings. But since your revenue could fluctuate from one month to the next, from one season to the next, or even from one year to the next, it’s difficult to pinpoint a precise typical weekly income.

The amount of money you made in the twelve months before to your application is what SDI uses to determine your benefit amount.

- For around seventeen months prior to the onset of your disability and roughly five months prior to the start of your impairment.

This twelve-month period is referred to as your base period. You need to have worked and paid Social Security taxes on $300 or more in your base period to be eligible for SDI benefits. SDI then splits the 12-month baseline into four equal halves. They calculate your benefit amount based on the quarter in which you made the most money.

Example

Since you’ll be starting your disability benefits in January of 2024, the dates of October 1, 2022, through September 30, 2023, determine your base period. In order to calculate SDI, divide your base period into four quarters and examine your wages for each quarter:

- Your paycheck for the months of October, November, and December in 2022 was $1,000.

- You earned $13,000 in the first three months of 2023.

- There was a three-month pay gap in 2023.

- You earned $11,000 in the summer months of 2023.

- For the purpose of determining your benefit payment amount, SDI will use your highest income of $13,000 from January, February, and March of 2023.

SDI determines your average weekly wage for the quarter in which you made the most money. Typically, your weekly SSDI payments will range from $50 (the least) to $1,620 (the maximum), which is 60-70% of your normal weekly salary.

Take note that the precise benefit computation fluctuates between 60% and 70%. The majority of people receive a lesser amount, while those with really low incomes typically receive a higher one.

Example

According to SDI’s calculations, your maximum quarterly salary in the given scenario was $13,000. During that quarter, you earned $1,000 every week ($13,000 ÷ 13), because one quarter is equal to thirteen weeks. About $600 per week ($1,000 ×.60) is your weekly SDI benefit amount, which is approximately 60% of your weekly income.

Base period exceptions

It is possible that your base period salaries were low due to circumstances beyond your control; SDI takes this into account. In order to increase your SDI benefit or ensure that you qualify for SDI if your wages were not high enough, it is possible to use your pay from a quarter prior to the usual base period.

You may be eligible to deduct last quarter’s earnings if you were:

- Serving in the armed forces

- Enrollment in Workers’ Compensation

- Dismissed due to an ongoing labor conflict

- More than 60 days without a job in a quarter (only if you weren’t eligible for SDI at the time)

Coverage Duration

If all goes according to plan, you should expect to receive your first benefit payment no later than two weeks after submitting your claim, with further installments spaced every two weeks thereafter. The majority of people nowadays get their paychecks sent to their bank accounts or used as a debit card to make purchases. Checks can be sent to you via regular mail if that is more convenient for you.

The date your doctor or healthcare provider indicated on your claim form as the expected return to work for your benefit term is often the date by which your coverage finishes. You will receive notice from SDI that your benefit is terminating on that date. Together with your doctor, you can request an extension of your disability benefits if you are still unable to work.

It is possible to submit a “continuous claim certification” through your SDI Online account or by regular mail at regular intervals if you are receiving benefit payments from EDD. Notify EDD without delay if you have regained your ability to work, whether it’s part-time or full-time, or if you receive any other form of income. Also, if someone receiving SDI payments passes away, you need to report it right once. You risk receiving more money than you are legally due from EDD if you don’t inform them. They will demand repayment for what is known as an overpayment.

SDI is designed to cover income loss for a maximum of 52 weeks. What this implies is that you can keep receiving benefits until you’ve spent 52 times your weekly benefit value. A benefit period exceeding 52 weeks is possible if you are working part-time or have your benefit decreased for any other reason. To learn more about what to do if you have a part-time job, read on.

Take note that you are limited to 8 weeks of Paid Family Leave annually and that the maximum benefit term for Elective Coverage is 39 weeks.

Part-time Jobs

You may be able to keep receiving SDI payments if you go back to work part-time. You will keep receiving your full Social Security disability benefit amount if the sum of your benefits and your part-time earnings is less than your weekly earnings shortly before your disability started.

Example

Prior to your disability, you were earning $1,000 per week; now, you receive $700 per week from SSDI. You get a part-time job again and make $200 per week. You receive $900 per week after deducting your SDI benefit from your part-time earnings. You will continue to receive the entire amount of your SDI benefit even though this is less than the $1,000 you were earning prior to your impairment.

Reduced SSDI payments occur when a person’s part-time earnings plus SDI benefits exceed their earnings prior to the start of their disability.

Example

You were making $1,000 per week before you became disabled, but your Social Security disability payment is only $700 per week. You return to your job and earn $600 every week. Your weekly earnings would exceed your SDI benefit if it remained at $700, coming to $1,300. To ensure that your weekly earnings remains at $1,000 or below, SDI reduces your benefit amount to $400. This means that you will have that $400 plus the $600 you earn, bringing your total income back to what it was before you became incapacitated.

Additional Benefit Cuts

There are a lot of factors outside part-time job that could reduce your benefit. SDI treats several forms of income as if they were wages. Any or all of the following can lessen the amount of money you get from SDI, depending on your circumstances:

- Commissions

- Bonuses

- Holiday compensation

- Pay for sick days

- Payouts for workers’ compensation

- Military Pay

- Other income

The SDI does not include earnings from vacation time. Take note that you are still required to disclose all income to SDI, regardless of whether it impacts your benefit payments or not.

Even if it takes more than 52 weeks, you can continue to get partial benefits until they are paid in full.

Example

With an SDI benefit of $100 each week, your total entitlement is $5,200 after 52 weeks. You have received $2,600, or half of that amount, after six months. Assuming you return to part-time employment and your benefit drops to $50 per week, you will continue to receive that amount until you have accrued $2,600 in benefits, which will take around another year.

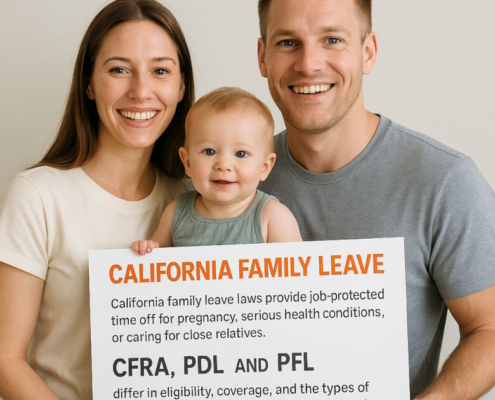

Paid Family Leave (PFL)

The SDI program includes PFL. Providing financial support to a critically ill family member (parent, child, parent-in-law, grandchild, grandparent, spouse, sibling, or registered domestic partner) or bonding with a new born does not require additional payment; it is available to those who have had SDI taxes deducted from their salaries.

The formula for determining the amount of your weekly PFL benefit is the same as that for SDI; you use a base period and average your weekly pay from the quarter in which you made the most money to determine the amount. Similar to SSDI, if you receive money from other sources, such as holiday pay, commissions, bonuses, sick leave, or any other type of income, your benefit amount may decrease.

Nevertheless, PFL does differ in a few key respects:

- PFL has its own unique claim form. If you want to know how to apply for PFL online or by mail, EDD has you covered with their video tutorials.

- A doctor’s certification of illness is required if you intend to use PFL to care for a sick relative.

- There is a yearly cap of 8 weeks for PFL.

- While certain businesses are required to comply with federal and state rules regarding leave, PFL does not guarantee job security.

- For PFL, there is no waiting period of seven days.

Pregnancy as a disability

In SDI’s eyes, being pregnant is a medical condition that can render you unable to work. The benefit period typically lasts from four weeks before your due date until six weeks following delivery for pregnancies that do not have any difficulties. The claim form must be signed by your doctor to indicate that you are unable to work beyond that time due to pregnancy or recuperation. After that, it will be treated similarly to any other medical condition that prohibits you from working. When it comes to SDI and pregnancy, EDD addresses common concerns.

An additional PFL claim for parental leave to bond with a newborn is not necessary after the birth of a child. After your SDI benefit expires, you will receive a form to complete. Just like when you were pregnant, you will get a benefit check. So, if you’re an SDI beneficiary and your pregnancy goes smoothly, you’ll get SDI for four weeks leading up to and six weeks after the baby is born, and you have extra time to bond with your new little one for an extra six weeks if you want to. To help with the transition from SDI to PFL, EDD has put up a video tutorial.