What is Overtime?

What is overtime? Overtime refers to the additional hours worked by an employee beyond their standard work schedule. In California, the standard schedule is typically 40 hours per week, but state laws also require overtime pay for working more than eight hours in a single day. Overtime meaning and overtime definition are critical to understanding your rights as an employee. Failure to pay overtime is illegal, and seeking advice from an attorney can clarify your rights.

What is Overtime Pay?

Overtime pay is the compensation owed to employees for the extra hours they work beyond the standard schedule. What does overtime mean for workers in California? It means being fairly compensated for additional effort. California overtime law mandates that non-exempt employees must receive overtime pay at a rate of one and a half times their regular hourly wage for any hours worked over eight in a single day or 40 in a single workweek. In some cases, employees may also be entitled to double-time pay. Employers who do not adhere to these rules are acting illegally, and employees should consider consulting a lawyer to address violations.

How Much is Overtime Pay?

How much is overtime pay? The amount of overtime pay is calculated based on an employee’s regular hourly rate. Under California law, the overtime pay rate is typically 1.5 times the standard hourly wage. For example, if an employee earns $20 per hour, their overtime pay rate would be $30 per hour for each hour worked beyond the standard schedule. Double overtime, which applies in specific circumstances, would be $40 per hour in this example. Not paying the correct overtime rate is illegal, and employees should consult an attorney for guidance.

The Basics of California Overtime Law

What is considered overtime in California? Overtime laws in California are stricter than federal standards. California Labor Code Section 510 requires employers to pay overtime to non-exempt employees in the following situations:

- For hours worked over eight in a single workday.

- For hours worked over 40 in a single workweek.

- For the first eight hours worked on the seventh consecutive day of work in a single workweek.

- Double-time pay for hours worked over 12 in a single day or over eight hours on the seventh consecutive day of work in a workweek.

Employers who fail to comply with these laws are acting illegally, and employees should consider seeking legal counsel.

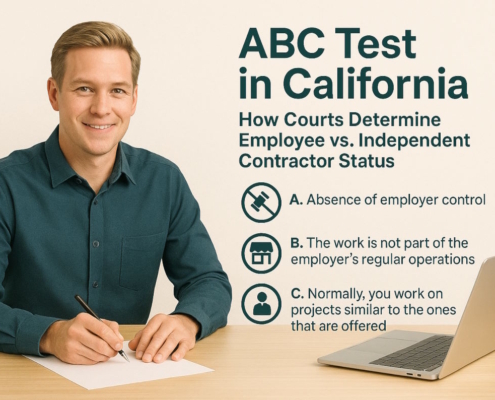

Non-Exempt vs. Exempt Employees

Who is exempt from overtime pay? To determine whether an employee is entitled to overtime pay, it is essential to understand the distinction between non-exempt and exempt employees. Non-exempt employees are covered by California’s overtime provisions, while exempt employees are not. Exempt status typically applies to employees who perform certain types of job duties, such as executive, administrative, or professional roles, and who earn a salary above a specified threshold. For 2023, the minimum salary for exempt employees is $64,480 annually for employers with 26 or more employees.

Misclassifying employees as exempt when they should be non-exempt is a common mistake that can lead to significant legal issues for employers. Can exempt employees get overtime? Typically, they cannot unless they are misclassified or performing non-exempt duties. It is crucial for employers to carefully evaluate job duties and compensation to ensure proper classification. Misclassification is illegal, and employees should consult a lawyer to address any concerns.

Situations Where Not Paying Overtime Is Illegal

There are several scenarios in which not paying overtime is considered illegal under California law:

- Failing to Pay Overtime to Non-Exempt Employees: If a non-exempt employee works more than eight hours in a day or 40 hours in a workweek and does not receive overtime pay, this violates California Labor Code.

- State Law Violations: Employers must comply with California’s specific overtime rules, which are more stringent than federal standards.

- Improper Deductions: Employers may not make deductions from an employee’s pay that would effectively reduce their overtime compensation. For instance, requiring employees to “work off the clock” or not recording all hours worked can be illegal.

- Retaliation: Employers are prohibited from retaliating against employees who raise concerns or file complaints about unpaid overtime. Retaliatory actions, such as termination or demotion, can result in additional legal consequences.

Violations of overtime laws are illegal, and employees should contact an attorney to understand their legal rights.

Exceptions and Exemptions

While California overtime and federal overtime laws provide robust protections, there are exemptions to the overtime rules. These include the following:

- Executive, Administrative, and Professional Employees: Employees in these categories may be exempt if they meet specific criteria related to job duties and salary.

- Outside Sales Employees: Workers whose primary duty is making sales away from the employer’s primary business location are typically exempt from overtime pay.

- Certain Seasonal and Agricultural Workers: These roles often have unique rules that differ from standard overtime requirements.

- Highly Compensated Employees: Employees earning above a certain salary threshold and performing specific duties may also be exempt.

Understanding these exemptions can help employees determine whether their employer’s practices are illegal, and consulting a lawyer is advisable in cases of uncertainty.

Consequences of Failing to Pay Overtime

Failing to pay overtime can lead to significant legal and financial consequences for employers. Is it illegal to not pay overtime after 40 hours? Yes, in most cases. Employees who believe they have been denied overtime pay can file a complaint with the California Division of Labor Standards Enforcement (DLSE) or pursue a private lawsuit. Potential penalties for non-compliance include:

- Back Pay: Employers may be required to compensate employees for unpaid overtime, including interest.

- Liquidated Damages: Employers may owe additional damages equal to the amount of unpaid overtime.

- Fines and Penalties: The DLSE may impose fines or other sanctions for violations.

- Legal Fees: Employers found liable may also be responsible for the employee’s legal fees.

Not addressing overtime violations is illegal and can lead to severe consequences. Employees should seek advice from an attorney to recover unpaid wages.

Real-Life Examples

Consider the following examples to better understand overtime laws in California:

- Example 1: An employee works 10 hours on Monday and 9 hours on Tuesday. How is overtime calculated? They are entitled to 2 hours of overtime for Monday and 1 hour for Tuesday, as California law mandates overtime pay for hours worked over eight in a single day.

- Example 2: An employee works 56 hours in a week, including seven consecutive days. Employers are required to pay overtime after how many hours have been worked? The answer is 40. They are entitled to overtime pay for the additional hours beyond 40 in the week and the first eight hours on the seventh day, plus double-time pay for hours worked over eight on the seventh day.

Employers who fail to follow these calculations are engaging in illegal practices. Consulting a lawyer is recommended in these situations.

Tips for Employers and Employees

For Employers

- Stay Informed: Regularly review California labor laws to ensure compliance.

- Proper Classification: Carefully assess whether employees are exempt or non-exempt based on their job duties and salary.

- Accurate Recordkeeping: Maintain detailed records of employee hours worked and compensation paid.

- Provide Training: Educate managers and HR staff about overtime rules and best practices.

For Employees

- Know Your Rights: Familiarize yourself with California’s overtime laws.

- Document Hours Worked: Keep a personal record of your work hours in case of disputes.

- Speak Up: If you believe you are not receiving proper overtime pay, address the issue with your employer or consult an employment attorney.

Knowing your rights protects you from illegal actions by employers. A lawyer can provide essential support if issues arise.

What to Do If Your Employer Is Not Paying Overtime

If your employer is not paying you overtime, you have several options:

- Raise the Issue with Your Employer: Inform your employer that you believe you are entitled to overtime pay. Provide specific dates and hours worked as evidence.

- File a Wage Claim: Submit a wage claim with the California Division of Labor Standards Enforcement (DLSE) to recover unpaid wages.

- Consult an Attorney: Seek legal advice from an experienced California employment lawyer to explore your options for recovering unpaid wages.

- Document Your Hours: Keep detailed records of the hours you work, including any overtime, as well as any communication with your employer regarding pay disputes.

Failing to pay overtime is illegal, and seeking help from a lawyer can ensure your rights are protected.

Conclusion

What is considered overtime in California? In California, it is illegal not to pay overtime to non-exempt employees who work beyond the standard hours defined by state law. Employers must be diligent in understanding and adhering to these regulations to avoid costly penalties, while employees should be aware of their rights and take action if they suspect violations. By fostering a workplace culture of transparency and compliance, both parties can contribute to fair and lawful employment practices. Contacting a lawyer ensures that illegal practices are addressed promptly.