What Happens If I Don’t Get Paid on Payday?

If you don’t get paid on payday, it is a violation of California Labor Code Section 204, which requires wages to be paid on time. You can file a complaint with the Division of Labor Standards Enforcement (DLSE) to recover unpaid wages. A lawyer can help you recover unpaid earnings if your employer does not pay you due to misclassification. Employees should consult a lawyer if their employer does not pay them the wages they are owed. If your employer does not pay you for your work, contacting an attorney can clarify your rights. An attorney can provide support if your employer does not pay you or delays your wages unlawfully. Employers may also face penalties for failing to meet their payday obligations. Lost wages, known as “back pay,” are the amounts you earned for working that should have been paid but weren’t. If your employer failed to pay you for all of your work hours, a court could award you back pay. If your employer does not pay you, consulting a lawyer can help determine the best course of action.

How Late Can a Business Pay You?

California labor laws require wages to be paid within specific timeframes. Regular wages must be paid semi-monthly, while overtime wages must be paid no later than the next regular payroll period. Delays beyond these timelines can result in financial penalties for the employer. According to California Labor Code Section 210, employers who fail to pay workers on time are subject to financial penalties. If an employer does not pay you your final wages, a lawyer can assist in recovering waiting time penalties. For initial violations, the penalty is $100 per employee who receives a late paycheck. For additional violations, employers incur a $200 penalty per employee, along with 25% of the unpaid wages. This higher penalty can also apply to an employer’s first violation if the withholding of payment was intentional. If an employer does not pay you on time, a lawyer can assist in filing a claim to address these violations.

Can You Refuse to Work If You Haven’t Been Paid?

Employees have the right to refuse work if wages are withheld, but this should be approached cautiously. It’s advisable to consult an employment attorney before refusing work to ensure compliance with legal obligations and avoid potential disputes. If your employer does not pay you on time, a lawyer can explain your options under California law. In some cases, it may make sense to file a claim with the state’s labor commission or consult with an attorney to determine the best course of action. Filing a complaint with the Division of Labor Standards Enforcement (DLSE) is another option if an employer refuses to address unpaid wages.

What Happens If I Don’t Get Paid 72 Hours After I Quit?

If you do not receive your final paycheck within 72 hours of quitting without notice, the employer is in violation of Labor Code Section 202. You may be entitled to waiting time penalties equal to your daily wage for each day the payment is delayed, up to 30 days. These penalties aim to deter employers from withholding wages unfairly and ensure that employees receive their final paychecks promptly. The waiting time penalty is calculated using the employee’s daily wage rate, and it includes weekends and holidays until the payment is made. In cases where an employer does not pay you within the required time, a lawyer can guide you through legal recourse.

What Can I Do If My Employer Keeps Paying Me Late?

If your employer consistently pays you late, you can file a claim with the DLSE or pursue a private lawsuit for wage theft. Repeated violations may also result in penalties under Labor Code Section 210, and you may recover damages for financial harm caused by the delays. If your employer does not pay you regularly, an attorney can help secure the compensation you are owed. According to California law, employees can recover back pay, waiting time penalties, and interest on delayed wages. Employers who engage in habitual late payments may also face additional legal consequences, including lawsuits under California’s Private Attorney General Act (PAGA).

Timely Wage Payment Laws in California

In California, state labor laws are clear: employers are required to pay employees for their work on a timely basis. Workers must be paid at least twice per month on regular paydays designated in advance by the employer. According to California Labor Code Section 204, work performed between the 1st and 15th of a month must be paid by the 26th of that month, and work performed between the 16th and the end of the month must be paid by the 10th of the following month. California’s labor laws aim to ensure that workers receive timely compensation and are not subject to undue financial stress. If your employer does not pay you according to California’s wage laws, seeking advice from a lawyer is crucial.

Overtime Wage Payment

The situation is more specific for overtime wages. Overtime pay must be included in the paycheck no later than the payday for the next regular payroll period following the one in which the overtime hours were worked. Employers are required to comply with Labor Code Section 226(a) by providing an itemized statement that includes total hours worked, hourly rates, and wages earned. Employers who fail to pay overtime wages on time may face additional penalties, and employees may file claims to recover unpaid overtime along with any applicable interest. When an employer does not pay you overtime wages, consulting an attorney can help recover what is rightfully yours.

Final Paycheck Rules

If an employee quits without providing 72 hours’ notice, the employer has 72 hours to issue the final paycheck. However, if the employee provides at least 72 hours’ notice, the employer must pay all owed wages on the employee’s final workday. In cases of termination, the employer must provide the final paycheck immediately upon discharge. These rules are outlined in Labor Code Sections 201 and 202. Employees who do not receive their final paychecks on time may also be entitled to waiting time penalties.

Penalties for Delayed Wages

When wages are delayed, California imposes strict penalties. Under Labor Code Section 203, if an employer willfully fails to pay wages due at the time of termination or resignation, the employer must pay a waiting time penalty equal to the employee’s daily rate of pay for each day the wages remain unpaid, up to 30 days. This penalty accrues regardless of whether the employee is part-time, full-time, or temporary. Employers who fail to pay wages on time may also be required to reimburse employees for any financial losses incurred due to the delay. Consulting a lawyer is important if an employer does not pay you within the mandated timeframes.

Legal Consequences for Employers

Employers who violate California’s wage payment laws may face additional financial consequences. According to Labor Code Section 210, employers are subject to penalties of $100 per employee for an initial violation of late paycheck rules and $200 per employee for subsequent violations, plus 25% of the unpaid wages. Employers can also be sued for damages, including back pay, interest, and attorneys’ fees. Employees can file claims with the Division of Labor Standards Enforcement (DLSE) or initiate private lawsuits. Employers found guilty of wage theft may also face criminal charges in severe cases. A lawyer can provide valuable guidance if your employer does not pay you or commits wage theft.

Steps to Address Unpaid Wages

Workers experiencing unpaid or delayed wages should take several steps to protect their rights. First, address the issue directly with the employer or HR department, as administrative errors can sometimes cause delays. If the issue persists, employees should document all interactions and send a formal written request for payment. “Retaliation for making such a report is illegal in California and many other jurisdictions,” notes employment attorney Brad Nakase. Legal remedies such as filing a claim with the DLSE or pursuing a lawsuit may also be necessary to recover unpaid wages.

Importance of Timely Wage Payment

Understanding the timelines and penalties for unpaid wages is critical. For instance, an employer’s inability to pay is not a valid defense for failing to provide wages on time. Employers must comply with wage payment laws even during financial difficulties. Moreover, the waiting time penalty continues to accrue until wages are paid or an action is filed in court. Filing a wage claim with the DLSE does not stop the penalty from accruing. Seeking legal counsel is essential when an employer does not pay you in accordance with the law. Timely payment of wages helps ensure financial stability for workers and avoids unnecessary legal disputes.

Misclassification and Wage Recovery

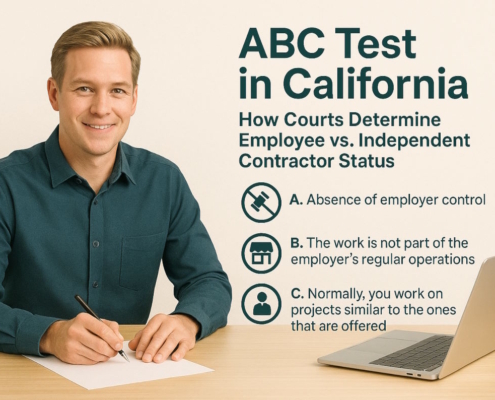

In cases involving misclassification, employees classified as independent contractors may be entitled to wages and overtime if they can demonstrate that their classification was incorrect. Misclassification can lead to unpaid overtime and benefits, which are recoverable under California law. Employers who misclassify workers may face additional penalties and legal claims for unpaid wages.

Accurate Wage Statements

Employees are also entitled to accurate and complete wage statements. Employers must maintain payroll records for at least three years and make them available to employees upon request. Failure to comply with record-keeping requirements can result in penalties. Wage statements must include details such as hours worked, gross wages earned, and any deductions, ensuring transparency in wage payments. If your employer does not pay you accurately, a lawyer can review your wage statements and advocate on your behalf.

Conclusion

When an employer delays or withholds wages, the consequences can extend beyond monetary penalties. Workers may experience financial stress and uncertainty, making timely payment of wages essential. California’s labor laws aim to protect workers from such hardships and ensure they receive fair compensation for their labor. Employees who take action to recover unpaid wages can rely on state and federal laws to safeguard their rights.