Introduction

Many gyms are employing and classified personal fitness trainers as independent contractors. The reality is that fitness instructor at a studio should nearly always be classified as an employee. There is a common misclassification of these personal trainers as independent contractors. The misclassification of personal trainers denies these employees rights guaranteed in California. While saving millions of dollars, fitness gyms in California are knowingly or inadvertently not living up to what is required of them.

This article uses these terms interchangeably: personal trainers, fitness trainers, and fitness instructors.

California AB 5 Law for Personal Trainers

Under California AB-5, a worker is presumed to be an employee—and the burden to demonstrate their independent contractor status is placed squarely on the shoulders of the hiring company. To do this successfully, a fitness studio must demonstrate (the emphasis is on “demonstrate” as scrupulous documentation is critical) that the fitness instructor satisfies all three criteria of the test (1 or 2 doesn’t cut it).

“The enforcement of AB-5 California means that many fitness studios must convert their personal trainer independent contractor agreement into formal employment offers to align with state law.”

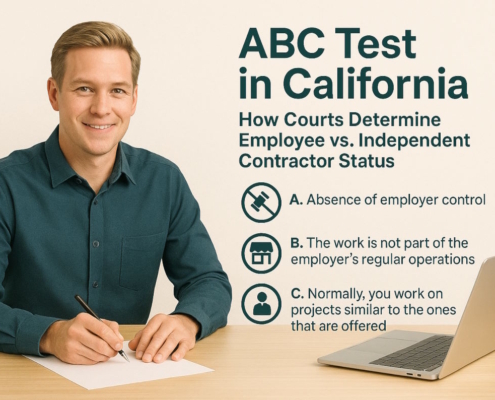

A worker, personal trainer, or fitness instructor can be classified as an independent contractor if:

(a) the worker is free from control and direction in the performance of services; and (b) the worker is performing work outside the usual course of the business of the hiring company; and (c) the worker is customarily engaged in an independently established trade, occupation, or business.

Are Gym Owners Required to Pay for Fitness Trainers Uniforms

Where a personal trainer is an employee, the gym owner must pay for the uniform. Gym owners often require fitness instructors to use the instructors’ own money to wear a uniform bearing the gyms’ logo. This is in direct violation of California state law, regarding purchasing work uniforms.

“Due to AB-5 California, the costs associated with providing a personal trainer uniform may now fall on the employer, highlighting the law’s impact on what was once considered an independent contractor’s responsibility.”

California Law Regarding Personal Trainers and Fitness Instructors

The state law is clear regarding claims for underpaid wages, poor record-keeping, and denial of meals and breaks. In the decision of Dynamex v. Superior Court (2018) 4 Cal.5th 903, it was established when a worker is considered an employee.

“Under AB-5 California, the personal trainer independent contractor agreement is under the microscope, pushing gym owners to reconsider the classification of their trainers.”

Personal trainers and fitness instructors are not considered employees if they are free from being controlled and directed by the party, hiring them. This is in regards to what that workers’ performance at their place of work would be. Another exception is if the personal trainers conduct work going beyond the normal scope of fitness gym’s business.

“Due to AB-5 California, the status of an independent contractor personal trainer is now harder to justify, forcing gyms to reevaluate their staffing models to ensure legal compliance.”

Another exception is if the personal trainer is usually involved in a trade, occupation, or business independently. This involvement would have to be similar to what the fitness trainer is doing for the hiring entity. All three of these are grouped together and called the “ABC Test.” This makes it clear to see if a personal trainer is an independent contractor or employee.

“The debate over AB-5 California extends to the attire of fitness professionals, with gym owners now potentially obligated to supply a personal trainer uniform under the new employee classification.”

The Dynamex decision was codified into law in September of 2019 by the governor, within Assembly Bill 5, or AB 5. This law now uses the ABC Test to determine whether a personal trainer is an employee or not. This shows just how fervently the state of California believes in the previous court decision. With AB 5 now the law in California, the ABC Test has become the gold standard of evaluating workers. It is now easy to identify whether a fitness trainer is an employee or an independent contractor.

This is momentous because it establishes that nearly every fitness studio in California has employees, not independent contractors. What’s more, is that this classification works retroactively. This is true even though the Supreme Court did not require the ABC Test to be applied in this way. Courts all over California have decided that it can be applied retroactively, and AB 5 confirms it.

The Consequences of Misclassifying Fitness Instructors

There have been significant consequences resulting from misclassifying personal trainers within the California fitness gym industry. The most significant effect has been gym studio owners avoiding paying what is due for operating a business in California. Other companies are required to do so, making it unfair for fitness studios to skirt the law.

“With the enforcement of AB-5 California, gym owners must now reassess their policies, including the requirement for a personal trainer uniform, ensuring they comply with employment standards rather than independent contractor guidelines.”

Gym studios that have not been complying with this law continue to break the law. These non-compliant fitness gym studios operate against the law until gym owners become aligned with what the law now states.

Workers Compensation Insurance for Personal Trainers

Fitness gym studio owners have been avoiding paying workers compensation for fitness instructors. This saves the fitness gym owners the cost of paying insurance premiums.

Off-the-Clock Work for Personal Fitness Trainers

Gym studio owners who pay their personal trainers a flat rate are not paying for the time outside of the fitness class. This includes tasks such as fitness instructors’ planning activities. The money gym owners should be paying their instructors for working outside of classes is being kept from personal trainers.

Rest Breaks and Meal Breaks for Personal Trainers

When gym owners pay fitness instructors a flat rate, the flat-rate pay is considered a piece-rate wage in California. Personal trainers paid a piece rate are entitled to get paid for time considered to be a rest break. This time would be paid at the regular rate of pay they receive. The amount of time would be 20 minutes within an eight-hour day.

Personal Trainer Must Be Paid for Standby Time

Additionally, fitness trainers should be getting paid for non-productive downtime, occurring before and after a class. This non-productive time also includes time spent in meetings, as well as training programs. The paid rate for this time should be at least minimum wage. When gym owners withhold paying for non-productive time, millions of dollars are being withheld from personal instructors.

“The AB-5 California legislation brings to light the need for standardized personal trainer uniforms as part of the employment benefits, marking a shift from the previous independent contractor model.”

California and Paid Sick Leave Laws for Personal Trainers

Owners of fitness gym have been skirting around paying their instructors paid sick leave. Personal trainers are employees and are entitled to California and city paid sick leave laws.

Gym Owner Record Keeping for Time

When gym owners classify personal trainers as independent contractors, the gym owners avoid tracking the time fitness trainers work hours. This also includes non-productive downtime for piece-rate workers. The lack of record-keeping hours often leads to class action lawsuits by personal trainers.

Gym Owners Payroll Taxes for Employees

Fitness gyms have not been paying payroll taxes by misclassifying fitness trainers as independent contractors. The misclassification of personal trainers as independent contractors also avoids unemployment insurance. What this usually leads to is personal trainers’ inability to get the unemployment benefits after leaving a gym.

Discrimination and Harassment Towards Personal Fitness Trainers

When studios misclassify their workers, they also avoid giving required sexual harassment training to them. There are protections mandated under Title VII of the United States Code, as well as the Fair Employment and Housing Act.

Wrongful Termination Against Fitness Instructors

Fitness instructors are often employees (not independent contractors), so they cannot be terminated if the reasons violate state public policy. Gym owners have attempted to protect themselves from being held liable by misclassifying personal trainers as independent contractors. California labor laws protect fitness instructors from being treated unfairly by their gym owners.

Waiting Time Penalties

According to the Labor Code § 203, when an employee was not given all the wages that are owed to them upon termination, they get another 30 days of pay. This section of the Labor Code also states the employer will have to pay waiting time penalties. Section 203 protects personal trainers.

Unreimbursed Expenses to Fitness Instructors

Gym owners must reimburse their personal trainers for the costs the trainers incur. This could include training, music purchases, or materials to be used during a class. Expenses such as these should be reimbursed by the gym’s owner, as stated under Labor Code § 2802. Independent contractors are not allowed to be reimbursed. This is another reason why gym owners have misclassified their instructors.

These are many of the most obvious ways fitness gym owners have cut costs. By misclassifying their personal trainers, they have been saving lots of money while doing so against the law. AB-5 now makes it very clear that what fitness gyms are doing violates state law. The misclassification of fitness instructors as independent contractors is considered one of the reasons for increased income inequality.

This law has been codified to stop the misclassification of personal trainers, so they receive fundamental rights and protections owed to them. This includes earning a minimum wage, workers’ compensation, unemployment insurance, paid sick leave, and paid family leave. Protections are now guaranteed for potentially millions of people.

“The AB-5 California’s influence on the fitness industry not only alters employment classification but also standardizes the provision of a personal trainer uniform, ensuring consistency across gyms.”

The enforcement of AB-5 in California has undeniably shifted the landscape for fitness studios and personal trainers. With the law’s emphasis on the ABC Test, it’s become imperative for gym owners to reevaluate their employment practices and ensure they’re in compliance. Not only does this involve a more careful consideration of how personal trainers are classified, but it also affects the practical aspects of their employment, such as uniform policies and the structure of their contracts.

“The debate over AB-5 California extends to the attire of fitness professionals, with gym owners now potentially obligated to supply a personal trainer uniform under the new employee classification. This signifies a move towards greater equity and professionalism within the industry.”

As gym owners and personal trainers navigate the complexities of AB-5, the legislation serves as a reminder of the evolving nature of labor laws and the importance of adapting to these changes. For personal trainers, the law offers a chance to gain the rights and benefits of employment status, including job security, health benefits, and a standardized approach to work attire and expenses.

“In light of AB-5 California, the traditional personal trainer independent contractor agreement must be scrutinized for compliance, as the law tightens the definition of an independent contractor.”

The fitness industry in California is at a turning point. AB-5 challenges the status quo, pushing for a fairer, more transparent relationship between gym owners and personal trainers. This includes acknowledging the importance of providing uniforms, ensuring fair wages, and recognizing the essential role personal trainers play in the wellness and fitness sector.

“Due to AB-5 California, the costs associated with providing a personal trainer uniform may now fall on the employer, highlighting the law’s impact on what was once considered an independent contractor’s responsibility.”