Brad Nakase, Employment Attorney

We can all agree that employers should fairly comply with minimum salary requirements. That every employer should classify you correctly, as an exempt worker, non-exempt, or independent contractor. That your pay should be fair and according to your classification.

As an employee, it is important to know your rights and what minimum salary you are entitled to receive under California’s employment laws. No employee should ever be cheated out of their deserved fair and minimum salary. First, you must be aware of the minimum salary requirements you are entitled to if you are an exempt employee.

Step 1: Determine if you’re an exempt employee.

Only an exempt employee can be paid a monthly salary; not all employees qualify as an exempt employee. An employee can determine if their employer has correctly classified them as an exempt employee by seeing if they met three certain requirements:

- Administrative Job Duties. An employee’s main duties in the workplace consist of clerical, professional, and executive office work.

- Independent Judgment. An employee must have the freedom to decide what to do in their work duties, making use of their discretion and their independent judgment.

- Minimum Salary. The salary of the employee must be at least twice the minimum wage for full-time employees.

If an employee meets all three requirements, then they are classified an exempt employee. Hence, they will be exempt from overtime pay, minimum wage pay, and the rest break requirements.

Step 2: Determine Minimum Salary Requirements

Non-Exempt employees are generally those who are paid an hourly wage. This is even if their duties are considered to be the same of those of exempt workers. The salary for non-exempt employees is strictly tied to the number of hours they work.

Under different circumstances, there may be certain exemptions for hourly-paid employees that may apply. This is generally when employees are paid by commission, are sales professionals/ outside salespersons, or even computer experts.

But generally, a salary is a fixed minimum payment that is paid to an employee, regardless of the hours they work, nor the amount of quality of their work.

| Date | Minimum Wage for Employers with 25 Employees or Less | Minimum Wage for Employers with 26 Employees or More |

| January 1, 2017 | $10.00/hour | $10.50/hour |

| January 1, 2018 | $10.50/hour | $11.00/hour |

| January 1, 2019 | $11.00/hour | $12.00/hour |

| January 1, 2020 | $12.00/hour | $13.00/hour |

| January 1, 2021 | $13.00/hour | $14.00/hour |

| January 1, 2022 | $14.00/hour | $15.00/hour |

| January 1, 2023 | $15.00/hour |

The Minimum Salary Amount Requirement

Although most employees are paid twice a month, some employees are paid a monthly salary. A monthly salary must be at twice the minimum wage for California, for full-time employment (40 hours per week).

The minimum salary for exempt workers can be determined by doubling the current minimum wage in California, multiplying by 40 (the hours per week), multiplying the result by 52 (weeks in a year), and lastly diving it by 12 (months in a year). The result is the required monthly salary.

As of 2021, the minimum wage for employees and minimum salary for exempt employees depend on the number of employees an employer has.

An employer with 25 or less employees must pay their employees a minimum wage of $13.00 an hour, and a minimum salary of $4,506.67 per month (or $54,080.00 annually) to exempt employees.

An employer with more than 25 employees must pay their employees a minimum wage of $14.00 an hour, and a minimum salary of $4,853.34 per month (or $58,240.00 annually) to exempt employees.

It must be noted that California’s minimum wage is set as to increase every year on January 1st until 2023. Hence, exempt employees’ minimum salary will also be increasing every year.

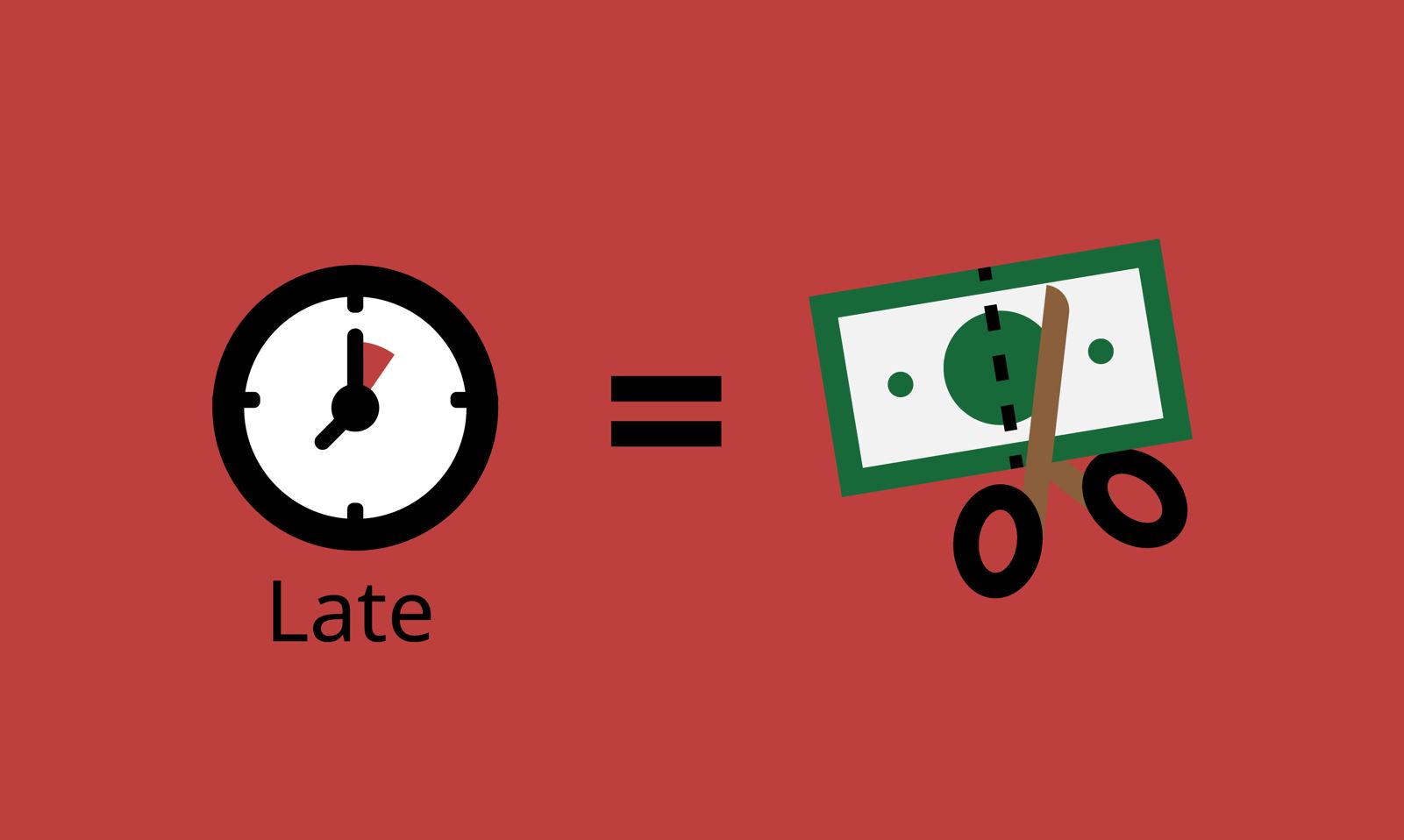

Salary Deductions As Disciplinary Action and For Absences

We can agree that it is outrageous and unfair for an employer to ever deduct an employee’s pay as a form of punishment. A person’s form of income should never have to suffer as a form of consequence.

California has a policy of an employer having to pay an employee the full wages they earned without deductions, except for those deductions authorized by law.

Under the federal law, an employer deducting an employee’s salary as a form of disciplinary action can rescind the classification of an employee as exempt.

Although, when it comes to missing days of work due to disciplinary suspension, an employee may keep their exempt status. This is only if their remaining salary that was earned during the month falls below the required threshold for exempt employees.

When it comes to absences, employers are allowed to make deductions for employees taking personal days and any unpaid vacation days. This is only if the deductions count as a full day of pay for the absence.

But, when an employer deducts an employee’s pay for missing less than a full day of work, the employee cannot be classified an exempt employee. Hourly employees may get their pay deducted for missing less than a full day of work, rather than a salary employee.

Employers can require their exempt employees to use the annual vacation or leave time for the days they miss work, even if they miss a full or part of a working day. This way, employees will not have their exempt status affected.

Exempt Jobs

Aside from other pay requirements, an employee may be exempt due to their occupation and job role. It is important for an employee to know the type of pay they are entitled to, based on their job and duties. Such occupations that are exempts are:

Commissioned Employees

Commissioned employees are exempt from the overtime pay laws of California. To be considered a commissioned employee, an employee must meet the following requirements.

- The earnings of the employee must be more than one-and-a-half times the minimum wage.

- The employee must be working in a retail, technical, or professional clerical industry.

- The commission payments for the employee should be more than half of their total compensation.

Commissioned payments are wage payments that an employee earns from the sales they make. Their compensation usually depends on the amount of product that they sell, or in the value of the products they sell.

Licensed Surgeons and Physicians

In the case of overtime compensation, physicians and surgeons may be exempt if they:

- Are paid at a minimum hourly rate of $84.79 an hour.

- The primary duties they perform require them to be licensed.

It is a limited application, as most physicians who are part of Unions and most medical interns and residents do not qualify for the exemption.

Computer Software Professionals

Employees working in the field of computer software and technology could be exempt from overtime compensation. This is only if they meet the following requirements:

- If paid salary, they must earn a minimum of $96,968.33 annually.

- If paid hourly, they must be paid a minimum of $46.55 an hour.

- They must hold high skills in computer systems, programming, and/or software engineering.

- Their primary work duties must involve design or development of computer software and or hardware.

- In their primary work duties, using independent judgment and discretion must be required of them.

- Must primarily be engaged in intellectual and/or creative work.

School Teachers At Private Schools

Some teachers at private schools may be considered exempts if they:

- Earn at least double the minimum wage in California.

- Have a bachelor’s degree or higher from an accredited institution or have a Teaching Credential from California or any other state.

- Teach students in kindergarten, or of grades 1-12.

Outside Salespersons

An outside salesperson may be exempt if they are:

- At least 18 years old.

- Spend more than half their time working away from the actual place of business.

- Sell items, types of services, contracts/agreements, and/or use of certain facilities and businesses.

Truck Drivers

Truck drivers can be exempts from overtime laws in California sometimes, but not necessarily from meal breaks or minimum wage pay.

The exemption from overtime laws applies to drivers who transport hazardous materials or those who are interstate truck drivers. Their hours are controlled mostly by the Federal regulations or the motor vehicle regulations in California.

Union Workers

Workers who are employed under a collective agreement or union – which help provide for the employees’ hourly work, their wages, and even their working conditions – may be exempt from overtime laws in California.

The Union must provide the premium wage for the overtime hours worked, and the regular rate of pay for minimum 30 % more than California’s minimum wage.

Other Job Exemptions

Other jobs and occupations that may have several exceptions to overtime laws in California include:

- An employer’s spouse, their children, and/or parents.

- Senior Home & Living managers.

- Childcare providers working in 24-hour residential facilities.

- Occupations in the field of agriculture.

- EMT and ambulance drivers.

- Personal attendants / Caregivers.

- Camp counselors.