How Does a Subsidiary Differ from a Parent Company in Corporate Structure?

A subsidiary operates as a distinct entity under a parent company, which oversees strategy, financial support, and compliance. Parent companies benefit from diversification, streamlined operations, and tax advantages while maintaining varying levels of control over subsidiaries.

How Do Revenue vs. Profit Impact a Company’s Financial Health?

Revenue reflects total earnings from sales, while profit accounts for expenses, revealing a company’s true financial health. Differentiating them helps businesses optimize strategies, ensure sustainability, and drive long-term success.

How Does Gross Profit Reflect Business Profitability?

Gross profit shows how much revenue remains after production costs, reflecting business profitability. Strong gross profit signals cost efficiency and financial health.

How Does a General Partnership Differ from a Sole Proprietorship?

A general partnership involves two or more individuals sharing ownership, responsibilities, and liabilities, while a sole proprietorship is owned and operated by one person. Partnerships offer shared decision-making and credibility, whereas sole proprietors retain full control but face unlimited personal liability.

How Is False Advertising Defined Legally?

False advertising laws prohibit businesses from making deceptive claims that mislead consumers into purchasing products or services. Consumers may file lawsuits, seek financial compensation, and hold companies accountable through federal and state regulations designed to prevent fraudulent marketing practices.

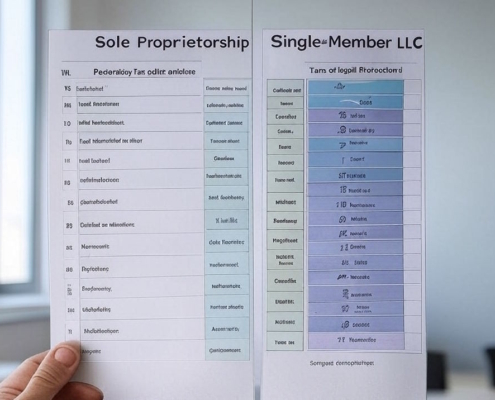

What Are the Differences Between a Sole Proprietorship and a Single-Member LLC?

A sole proprietorship offers simplicity but exposes personal assets to business liabilities, while a single-member LLC provides liability protection with additional costs. Choosing the right structure depends on factors like asset protection, taxation, and long-term business goals.

What Services Do Corporate Governance Lawyers Provide?

Corporate governance lawyers ensure businesses comply with legal standards, protect shareholder rights, and maintain ethical operations. They influence board decisions, draft policies, and navigate complex regulations to uphold corporate accountability and credibility.

How Can I Get Financial Help Starting a Business?

Small businesses can secure funding through grants, loans, and corporate programs without repayment. Federal, state, and private organizations offer financial assistance for various industries and needs.

W2 vs 1099: Key Tax Differences

W-2 and 1099 forms define tax obligations for employees and independent contractors. Proper classification prevents IRS penalties and ensures compliance.

How to Trademark Your Business Name

Protect your business name with trademark registration to ensure exclusive rights and safeguard your brand identity from infringement. Follow our step-by-step guide to navigate the trademarking process effectively while avoiding common pitfalls.